How To Calculate Earnings Multiple

Enterprise Value market capitalization value of debt minority interest preferred shares cash and cash equivalents EBITDA Earnings Before Tax Interest Depreciation Amortization. The relevant earnings base is multiplied by the earnings multiple to arrive at the business valuation.

Is This An Affordable Mortgage For Me Debt To Income Ratio Household Expenses Debt

Alan Since Im helping my friend the thought of separate calculations put me in a cold sweat but I think I have worked it out on the spreadsheet.

How to calculate earnings multiple. The priceearnings-to-growth PEG ratio is a companys stock price to earnings ratio divided by the growth rate of its earnings for a specified time period. Here is an outline of the process. The multiple of SDE increases as the size of SDE increases.

If I did it right the separate monthly calculations worked out to a higher total excess earnings by 24 than a single calculation of excess earnings combining all the monthly contributions. The appropriate multiple of earnings depends on the definition of earnings being used. Earnings Multiplier Market value per share Earnings Per Share EPS Moving on from the basics let us do a sample calculation with company XYZ that currently trades at 100 and has an earnings per share EPS of 5.

To Determine the Enterprise Value and EBITDA. This video demonstrates how to calculate th. A price multiple is a single number you can compare with price multiples of similar companies to see whether a stock might be overvalued or undervalued.

The earnings multiple is a common stock market metric that measures how much the market values a stock. The price earnings multiple compares the earnings per share reported by a company to the market price of its common stock. Investors can calculate the earnings multiple based on past earnings reports or estimate the ratio based on future projections.

Select LTM PE Multiple Step 3. EBITDA Multiple Enterprise Value EBITDA. Conclude on a Fair Value Range.

The first step in using the Multiple of Discretionary Earnings business valuation method is to determine the appropriate SDCF value. There are several different multiples you can calculate. This multiple is used by investors to judge how expensive a share of the companys stock is.

What factors determine the Multiple of earnings. A multiple of earnings is a valuation method whereby the value of a company is expressed through the use of a multiple applied to the Companys earnings. During a declining market the overall price earnings multiples tend to decline for the shares of all companies with the reverse occurring when the.

Each one is a ratio of a stocks price to some per-share financial number such as earnings per share or EPS. Adjusted EBITDA Leads to Multiples Confusion. Adding that 215000 of adjustments to the 785000 of EBITDA yields 1000000 of sellers discretionary earnings.

Multiple of earnings multiplies the earnings or income or profit of a year or average of years in order to come up with a figure representing the companys worth in a sale. Price to earnings is a common multiple used for this purpose. Lets say a company is reporting basic or diluted earnings per share of 2 and the stock is selling for 20 per share.

How to Value a Business in Excess of 5000000 Using EBITDA Multiples. Seem similar to the Capitalised Earnings method. Also known as Multiple of Sellers Discretionary Cash and other like worded descriptions.

The value of a business is usually based on EBITDA multiples for larger businesses. This value should best represent the expected future earnings. It involves multiplying a companys profits by a certain number to end up with a value.

Fair Market Value Earnings Multiplier. Select Forward PE Multiple Step 4. Multiple of Discretionary Earnings Method.

Typical ways of estimating the SDCF value used in this valuation method include. In that case the PE ratio is 10 20 per share 2 earnings per share 10 PE. An earnings multiple may be used to provide a guide to the valuation of a business.

More What Are a Companys Earnings. Read this article to learn how SDE vs. For instance a company that has Earnings Before Interest Taxes Depreciation and Amortization EBITDA of 2000000 that has a value of 10000000 was.

Select Comparable Companies Step 2. If you refer to the multiples chart for sellers discretionary earnings in Newsletter Issue 6 - How Small Businesses Are Valued Based on Sellers Discretionary Earnings SDE youll see that the appropriate multiple for SDE of 1000000 is 40x. This information is useful because if you invert the PE ratio you can find out a stocks earnings yield.

Average historic SDCF derived from your recast business financials. Multiples are a common method of valuing a company. Also known as the price-to-earnings or PE ratio this ratio is reached by taking the price of the stock and dividing it by the earnings per share of.

Multiple of earnings is one way to value a business. Small businesses with SDE less than 100000 sell for multiples in a range of 12 to 24 when SDE is greater than 100000 we expect to see the multiples in a range of 2 to 3 and as SDE reaches and exceeds roughly 500000 we see the range extend to 25 to to 35 or more.

Types Of Cash Flows Cash Flow Statement Cash Flow Investing

Earnings Before Interest Tax Depreciation And Amortization Ebitda Defination Example Financial Statement Analysis Financial Statement Income Statement

03x Table 07 Income Statement Financial Ratio Good Essay

Financial Ratio Analysis Google Search Financial Ratio Financial Statement Analysis Financial Engineering

Your Lifetime Wealth Ratio And How To Calculate It Insurance Marketing Social Security Benefits Cheapest Insurance

Profit Margin Guide Examples How To Calculate Profit Margins Financial Statement Analysis Cost Of Goods Sold Financial Analysis

Multiple Job Timesheet Printable Time Sheet Time Sheet Printable Schedule Template Timesheet Template

Worksheets For Calculating Price To Earnings Ratios Earnings Investing Invest Market Shares Investor Word Problems Math Facts Addition Math Worksheets

Free Small Business Valuation Calculator A Quick And Simple Way To Value Your Business Online Bizex Business Valuation Online Business Business

Agency Valuations The Truth About Ebitda Multiples Accounting Basics Business Analysis Income Statement

How To Calculate Your Savings Rate Determine When You Ll Reach Financial Independence In 2021 Saving Rates Financial Independence Sinking Funds

Ebitda Margin Multiple Formula Example Accounting Basics Accounting Course Financial Ratio

What Is Total Shareholder Return Tsr Capital Appreciation Investing In Stocks Investing

Statement Of Retained Earnings Reveals Distribution Of Earnings Earnings Financial Statement Business Questions

Free Small Business Valuation Calculator A Quick And Simple Way To Value Your Business Online Bizex Business Valuation Online Business Business

Best Credit Cards For Amex Membership Rewards Calculator Best Credit Cards Good Credit Membership Rewards

Multiple Step Income Statements Income Statement Statement Template Accounting Education

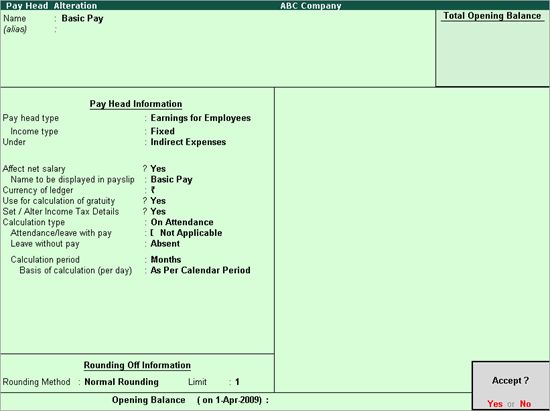

Creating Earnings Pay Head Payroll In Tally Erp 9 Voucher Data Migration Reference

Posting Komentar untuk "How To Calculate Earnings Multiple"